1. Client can access their portfolio in RED company through www.publicmutualonline.com.my where as in the BLUE company client need to call customer service. Convenient and more transparent vs inconvenient. A good point to service your client.

2. RED has a special privilege for Mutual Gold member (client that invest more than RM150k) where they can get a benefit of FREE Wasiat writing, trust nomination and insurance PA coverage. Added value to client and thus easier to sell. Imagine that the client can save RM1200 for wasiat and RM90 for trust nomination. So far the ONLY UTMC that can give the above service for FREE.

3. In terms of funds’ performance, RED has a better long-term track record with more than 308 awards whereas in BLUE company it is unknown how many awards that they have received so far. One of the awards received by the RED company is from FAILAKA for Best Islamic Fund Manager in Asia for 4 consecutive years. Thus it is easy to market the RED fund with a well-known track record. It will take a tough time if the client who knows the unit trust industry ask you if you are in the BLUE company “How do your company compare with the RED company”

4. RED, the No.1* private unit trust company and Private Retirement Scheme (PRS) provider in Malaysia, commands a market share of 40%^ for the retail funds sector and 40%^ for the PRS sector. RED total net asset value stands at RM80.5 billion^ as at end-May 2018. It means strong and thus insyaAllah dependable.

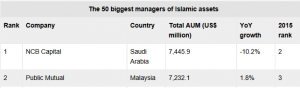

5. RED is not only jaguh kampung but RED is also ranked No. 2 in the world among the top 50 biggest global managers of Islamic funds in the world. Source: http://bit.ly/top50funds

6. RED has more than 131 unit trust funds, 4 wholesale funds and and 9 PRS funds. It means that more option for clients. More diversification for loacal and overseas funds.

7. Redemption and switching for the RED company is far easier than the BLUE company because the redemption form is made available at all branches. Redemption also can be done online. In the BLUE company, the redemption form is controlled by the GAM. It depends on how good your relationship with the respective GAM. This is one of the main reasons their agent switch to RED company. Imagine that if your client ask you to sell their fund but you cannot sell. Or you have to wait for a certain time.

8. In terms of promotion to AM and GAM, in RED company require less quota and easily achievable. For example, to become an AM, you need to have RM2.5m group sales and RM850k personal sales. You must have only 4 agents. The rolling period for promotion is deducted one month at a time while in the BLUE company, it will deduct 6-month straight away. Thus for you to be promoted in the BLUE company, it will take a longer time.

Imagine if you have closed BIGS sales say RM1.5mill on the first 6-month when joining the BLUE company and somehow you cannot achieve to become AM in 36 months – then after 37 months, they will deduct the whole first 6-month sales figure i.e. the RM1.5mill straight away from your promotion quota, thus you have to work hard again to clock in another new sales to recover the deducted sales.

9. In terms of qualifying for the free trips, in RED company, it has 3 levels e.g. in 2011 if your sales are RM700k, you qualify for Guangzhou, China. With RM1.5m you qualify for Tokyo, Japan and with RM2.85m you qualify for Los Angeles, USA. In the BLUE company, the point for EPF sales is half from cash sales. And thus in the BLUE company you need to clock in sales of roughly R4mill (almost double) to qualify for the free trip. It is unknown how many trips that they offer in the BLUE company. Your effort to qualify for trip in the RED company is half of that in the BLUE company.

It is said that the BLUE company has only one incentive trip? This mean that for you to recruit new agent, the chances for them getting free overseas trip is more than compared to if the new agent be in the BLUE company. Thus if you are thinking to recruit new agent, in the RED company has a better offer. Even though they cannot achieve RM4mill, if they achieve RM700k, the new agent can still enjoy the FREE trip to Guangzhou.

10. For rejected EPF case in the BLUE company, the agent has to bear the punishment cost of RM100? (check with the BLUE company) whereas in the RED company, the agent do not need to pay a dime. So cost of doing business in the RED company always lower than the red company.

Disclaimer: The above info is only valid when it is explained together with verbal communication face-to-face. And it is for the sake of answering question from the prospect who want to know the differences between RED and BLUE company. The final and correct info shall be gathered from SC and the respective company website.